Griffin Capital Net Lease REIT* Reports Second Quarter 2012 Results

EL SEGUNDO, Calif. (Aug. 23, 2012) – Griffin Capital Net Lease REIT, Inc. (the “REIT”) today announced operating results for the company’s second quarter ended June 30, 2012.

“Griffin Capital Net Lease REIT continued the strong momentum established at the beginning of the year. Through June, our portfolio grew nearly 64%, providing our stockholders greater geographic and industry diversification. We continue to build a stable, investment grade portfolio, adding strength to our cash flow and balance sheet,” stated Kevin Shields, chairman and chief executive officer of the REIT, “This year we added four outstanding assets to our portfolio, occupied by tenants representing over 13% of the historic core of the Dow Jones 30 Industrials: AT&T, Westinghouse, GE and Travelers Indemnity.” David Rupert, president of the REIT, added, “Our acquisitions team and debt capital market professionals have produced for us at a high level. We have been able to source and acquire long‐term leased assets occupied by high credit quality, investment grade tenants at attractive and competitive yields. We have further been able to source conservative and accretive debt, which has enhanced our distributable cash flow.”

Highlights and Accomplishments Year-to-Date through June 30, 2012

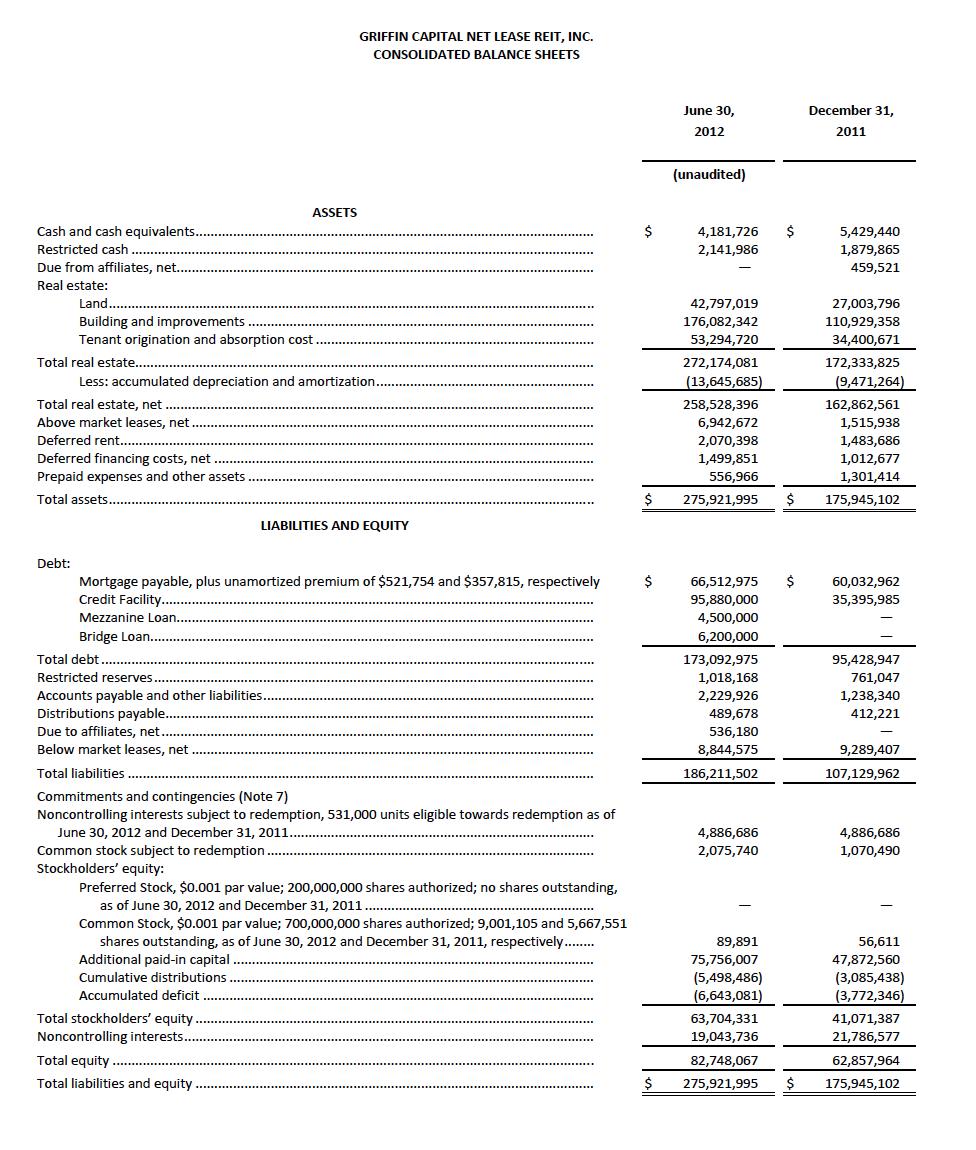

- In the first half of 2012 the REIT acquired four assets occupied by investment‐ grade rated tenants – AT&T Wireless, Westinghouse, GE Aviation Systems and Travelers Indemnity Group – with a total acquisition value of $105 million and a total of 520,000 square feet. The total dollar amount of the REIT’s portfolio increased 64%, from $165 million at the end of 2011 to $270 million at the close of the second quarter, consisting of 2.82 million square feet of 100% leased space.

- 68% of the portfolio rental revenue is generated by investment-grade rated companies.

- The weighted average remaining lease term is 9.7 years with average annual rental rate increases of 2.3%.

- Given the REIT’s average 4.3% interest rate on our debt, there is currently a 380 basis point positive spread relative to the REIT’s weighted average portfolio capitalization rate of 8.1%(1) . The REIT’s leverage ratio relative to total capitalization is 53%.

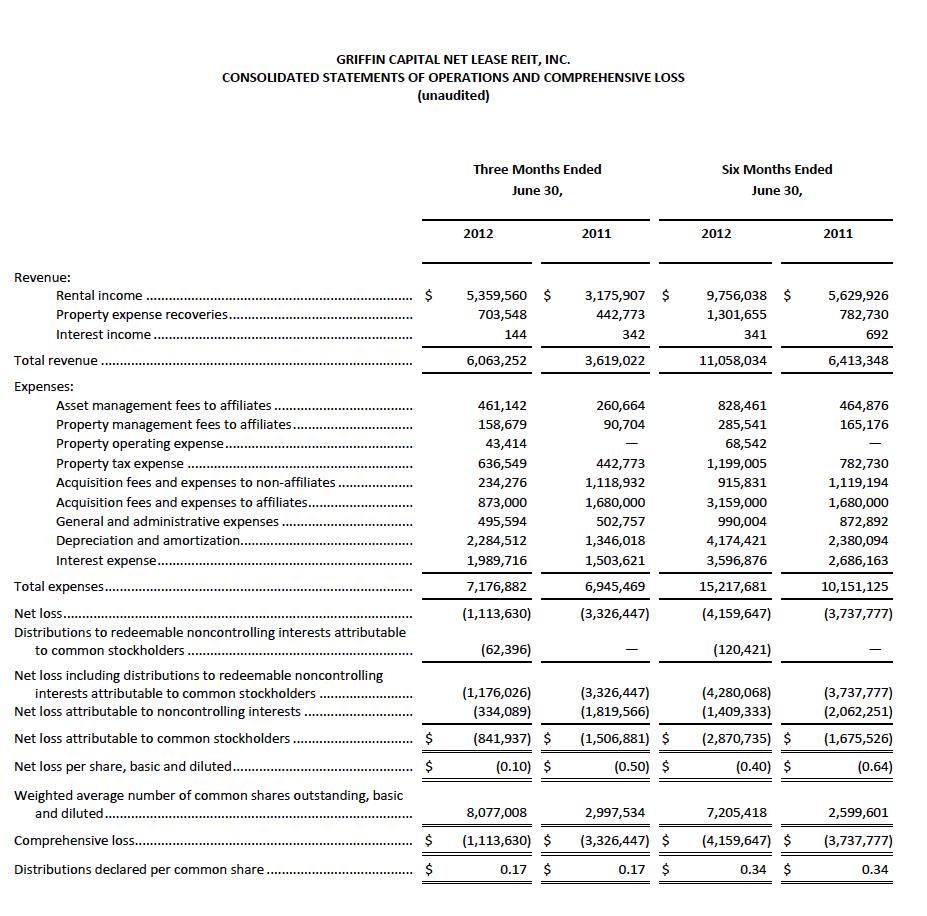

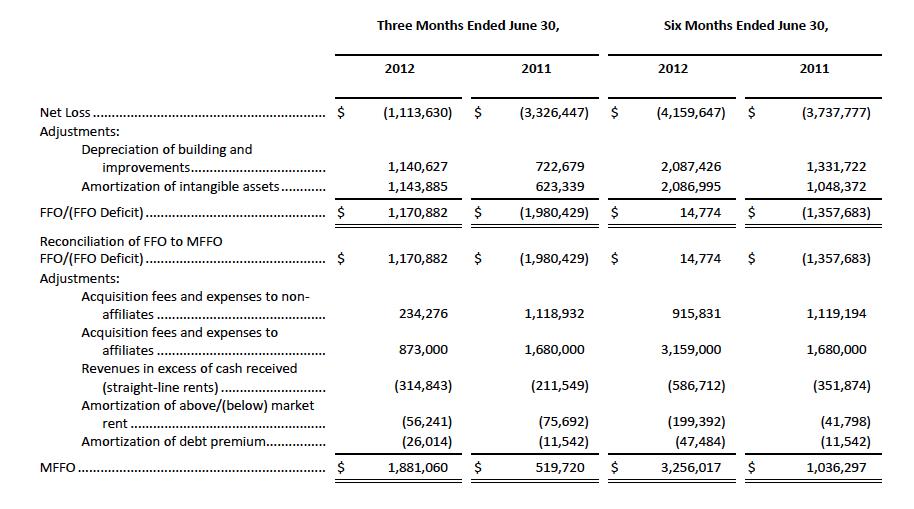

- Modified funds from operations, or MFFO, as defined by the Investment Program Association, equaled $1.9 million for the quarter, representing year-over-year growth of approximately 262% from the same quarter 2011. Funds from operations, or FFO, as defined by the National Association of Real Estate Investment Trusts, or NAREIT, equaled approximately $1.2 million, compared with $(2.0) million during the second quarter 2011. ( Please see financial reconciliation tables and notes at the end of this release for more information regarding MFFO and FFO.)

- The REIT’s $150 million credit facility was fully subscribed in the first six months of 2012 in which KeyBank and Bank of America were joined with commitments from North Shore Bank & Trust (a subsidiary of Wintrust Financial Corporation), Regions Bank and Fifth Third Bank.

“We could not be more pleased with the growth in our portfolio thus far this year and the incredible support we receive from both our broker-dealer partners and the existing and new members of our lending group”, concluded Mr. Shields.

_______________________

1 The estimated going-in capitalization rate is determined by dividing the projected net rental payment for the first fiscal year we own the property by the acquisition price (exclusive of closing and offering costs). Generally, pursuant to each lease, if the tenant is directly responsible for the payment of all property operating expenses, insurance and taxes, the net rental payment by the tenant to the landlord is equivalent to the base rental payment. The projected net rental payment includes assumptions that may not be indicative of the actual future performance of a property, including the assumption that the tenant will perform its obligations under its lease agreement during the next 12 months.

About Griffin Capital Net Lease REIT and Griffin Capital Corporation

Griffin Capital Net Lease REIT, Inc. is a publicly registered non‐traded REIT with a portfolio that currently includes eleven office and industrial distribution properties totaling approximately 2.8 million rentable square feet and total capitalization in excess of $300 million. The REIT’s sponsor is Griffin Capital Corporation (“Griffin Capital”), a privately‐owned real estate company headquartered in Los Angeles. Led by senior executives each with more than two decades of real estate experience collectively encompassing over $14.0 billion of transaction value and more than 400 transactions, Griffin Capital and its affiliates have acquired or constructed over 17 million square feet of space since 1996. Griffin Capital and its affiliates currently own and manage a portfolio consisting of over 11.1 million square feet of space, located in 27 states and representing over $1.7 billion in asset value. Additional information about Griffin Capital is available at www.griffincapital.com.

This press release may contain certain forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward‐looking statements can generally be identified by our use of forward‐looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward‐looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties relating to the public offering of our common stock; uncertainties related to the timing and availability of distributions; and other risk factors as outlined in the REIT’s prospectus, as amended from time to time. This is neither an offer nor a solicitation to purchase securities

GRIFFIN CAPITAL NET LEASE REIT, INC.

Funds from Operations and Modified Funds from Operations

(Unaudited)

Our management believes that historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered the presentation of operating results for real estate companies that use historical cost accounting to be insufficient. Additionally, publicly registered, non‐listed REITs typically have a significant amount of acquisition activity and are substantially more dynamic during their initial years of investment and operation. While other start‐up entities may also experience significant acquisition activity during their initial years, we believe that non‐listed REITs are unique in that they have a limited life with targeted exit strategies within a relatively limited time frame after the acquisition activity ceases.

In order to provide a more complete understanding of the operating performance of a REIT, the National Association of Real Estate Investment Trusts (“NAREIT”) promulgated a measure known as funds from operations (“FFO”). FFO is defined as net income or loss computed in accordance with GAAP, excluding extraordinary items, as defined by GAAP, and gains and losses from sales of depreciable operating property, adding back asset impairment write‐downs, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non‐real estate assets), and after adjustment for unconsolidated partnerships and joint ventures. Because FFO calculations exclude such items as depreciation and amortization of real estate assets and gains and losses from sales of operating real estate assets (which can vary among owners of identical assets in similar conditions based on historical cost accounting and useful‐life estimates), they facilitate comparisons of operating performance between periods and between other REITs. As a result, we believe that the use of FFO, together with the required GAAP presentations, provides a more complete understanding of our performance relative to our competitors and a more informed and appropriate basis on which to make decisions involving operating, financing, and investing activities. It should be noted, however, that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than we do, making comparisons less meaningful.

The Investment Program Association (“IPA”) issued Practice Guideline 2010‐01 (the “IPA MFFO Guideline”) on November 2, 2010, which extended financial measures to include modified funds from operations (“MFFO”). In computing MFFO, FFO is adjusted for certain non‐cash items such as straight‐line rent, amortization of in‐place lease valuations, accretion/amortization of debt discounts/premiums, nonrecurring impairments of real estate‐related investments, and certain non‐operating cash items such as acquisitions fees and expenses. Management believes that MFFO is a beneficial indicator of our on‐going portfolio performance. More specifically, MFFO isolates the financial results of the REIT’s operations. MFFO, however, is not considered an appropriate measure of historical earnings as it excludes certain significant costs that are otherwise included in reported earnings. Further, since the measure is based on historical financial information, MFFO for the period presented may not be indicative of future results or our future ability to pay our distributions.

By providing FFO and MFFO, we present information that assists investors in aligning their analysis with management’s analysis of longterm operating activities. MFFO also allows for a comparison of the performance of our portfolio with other REITs that are not currently engaging in acquisitions, as well as a comparison of our performance with that of other non-traded REITs, as MFFO, or an equivalent measure, is routinely reported by non-traded REITs, and we believe often used by analysts and investors for comparison purposes. As explained below, management’s evaluation of our operating performance excludes items considered in the calculation of MFFO based on the following economic considerations:

- Straight line rent, amortization of in‐place lease valuation and amortization of debt premiums. These items are GAAP non-cash adjustments and are included in historical earnings. These items are deducted from FFO to arrive at MFFO as a means of determining operating results of our portfolio.

- Acquisition-related costs. In accordance with GAAP, acquisition-related costs are required to be expensed as incurred. These costs have been and we expect will continue to be funded with cash proceeds from our public offering. In evaluating the performance of our portfolio over time, management employs business models and analyses that differentiate the costs to acquire investments from the investments’ revenues and expenses. By excluding acquisition-related costs that affect our operations only in periods in which properties are acquired, MFFO can provide an indication of operating performance after we cease to acquire properties on a regular basis. Management believes that excluding these costs from MFFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management.

For all of these reasons, we believe the non-GAAP measures of FFO and MFFO, in addition to net income and cash flows from operating activities, as defined by GAAP, are helpful supplemental performance measures and useful to investors in evaluating the performance of our real estate portfolio. However, a material limitation associated with FFO and MFFO is that they are not indicative of our cash available to fund distributions since other uses of cash, such as capital expenditures at our properties and principal payments of debt, are not deducted when calculating FFO and MFFO. Additionally, MFFO has limitations as a performance measure in an offering such as ours where the price of a share of common stock is a stated value and there is no net asset value determination during the offering stage and for a period thereafter. MFFO is useful in assisting management and investors in assessing the sustainability of operating performance in future operating periods, and in particular, after the offering and acquisition stages are complete and net asset value is disclosed. However, MFFO is not a useful measure in evaluating net asset value because impairments are taken into account in determining net asset value but not in determining MFFO. Therefore, FFO and MFFO should not be considered as alternatives to net income (loss) or to cash flows from operating activities and each should be reviewed in connection with GAAP measurements.

Neither the SEC, NAREIT, nor any other applicable regulatory body has opined on the acceptability of the adjustments contemplated to adjust FFO in order to calculate MFFO and its use as a non‐GAAP performance measure. In the future, the SEC or NAREIT may decide to standardize the allowable exclusions across the REIT industry, and we may have to adjust the calculation and characterization of this non‐GAAP measure.

Our calculation of FFO and MFFO is presented in the following table for the three and six months ended June 30, 2012 and 2011.

a) In evaluating investments in real estate, we differentiate the costs to acquire the investment from the operations derived from the investment. Such information would be comparable only for publicly registered, non‐listed REITs that have completed their acquisition activity and have other similar operating characteristics. By excluding expensed acquisition related expenses, we believe MFFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. Acquisition fees and expenses include payments to our advisor and third parties. Acquisition related expenses under GAAP are considered operating expenses and as expenses included in the determination of net income (loss) and income (loss) from continuing operations, both of which are performance measures under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to investors, the potential for future distributions, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of other properties are generated to cover the purchase price of the property, these fees and expenses and other costs related to such property.

(b) Under GAAP, rental revenue is recognized on a straight‐line basis over the terms of the related lease (including rent holidays). This may result in income recognition that is different than the underlying contract terms. By adjusting for the change in deferred rent receivables, MFFO may provide useful supplemental information on the realized economic impact of the underlying lease, providing insight on the expected contractual cash flows of such lease terms, and aligns results with our analysis of operating performance.

(c) Under GAAP, above and below market leases are assumed to change predictably in value over time. Similar to depreciation and amortization of other real estate related assets, that are excluded from FFO, so is the amortization of allocated above and below market lease value. However, because real estate values and market lease rates historically rise or fall with market conditions, including inflation, interest rates, the business cycle, unemployment and consumer spending, we believe that by adjusting this matrix for the amortization relating to above and below market leases, MFFO may provide useful supplemental information on the performance of the real estate.

(d) Under GAAP, we are required to record certain financial instruments, such as debt, at fair value at the acquisition date for each reporting period. We believe that adjusting for the change in fair value of our financial instruments is appropriate because such adjustments may not be reflective of on‐going operations and reflect unrealized impacts on value based only on then current market conditions, although they may be based upon general market conditions. The need to reflect the change in fair value of our financial instruments is a continuous process and is analyzed on a quarterly basis in accordance with GAAP.

* On February 25, 2013, Griffin Capital Net Lease REIT, Inc. announced its new name: Griffin Capital Essential Asset REIT, Inc.